Golf and the New Wellbeing Economy

How to Sustain Record On-Course Demand

Golf's boom continues: record numbers of players and new, diverse customers are coming to courses and clubs. But with rising costs, climate and water resource challenges, as well as the pressing need to invest in facilities and customer experiences, how do green grass courses sustain demand and profitability? We review golf’s recent performance, analyze the challenges and offer long-term solutions on how course businesses can benefit from an emerging ‘wellbeing economy’.

Golf On a Roll

GOLF is still on a roll. Data from the United States of America, the world’s largest golf market (with nearly 14,000 green grass golf courses and 27 million golfers), shows the industry is still riding a post-pandemic high.

As Greg Nathan, President & CEO of the National Golf Foundation (NGF), wrote in the foreword to the organization’s annual state-of-the-industry report1, the golf industry’s success could be summed-up in 30 seconds:

- Rounds were up in 2023

- On-course participation was up

- Off-course participation was up

- Female engagement was at an all-time high

- Beginners were at record levels

- Golf’s customer base is increasingly diverse

- Facility revenue and financial health was up

- More people were playing, watching and reading about golf

- Total number of green grass golfers was up more than 10% over the past five years.

What’s more, it is estimated 40% of Americans engaged with golf in 2023, either participating, watching, reading or following on social media.

The success of Olympic Golf in Paris 2024 will have done much to extend the global reach and appeal of the sport.

Evidently, golf continues to fly high.

But for an industry that is historically cyclical, there are also warnings of complacency.

Some course owners and operators are making hay today but failing to invest in product and customer service, putting tomorrow’s profitability at risk.

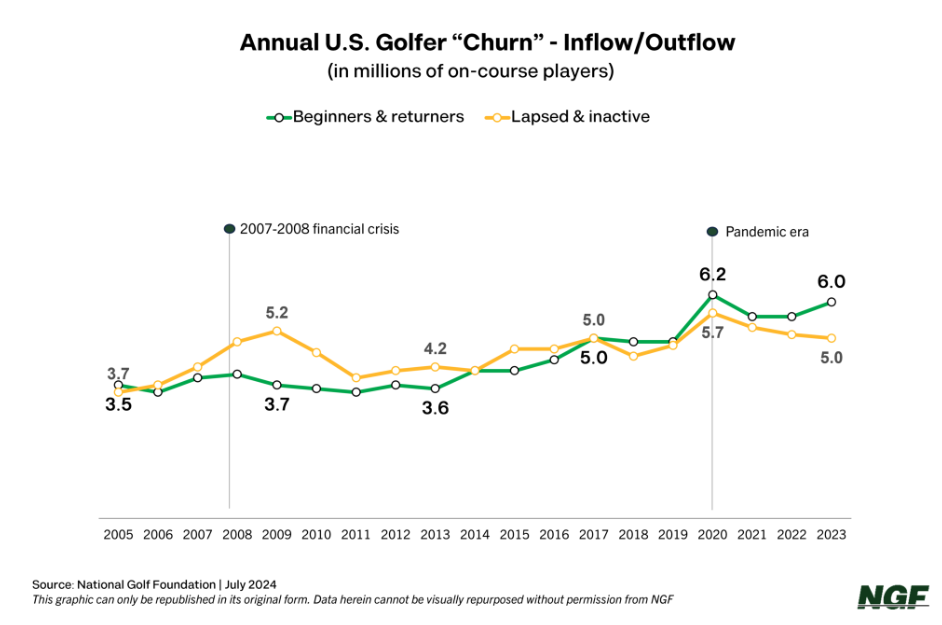

Of the nearly 27 million golfers who played on a green grass golf course in the US in 2023, six million were beginners or returners – yet there was only a net gain of one million players.

This, says Greg Nathan, is evidence of “failed trials.” But it is also a huge opportunity to better onboard new players and make golf more “sticky.”

“Golf is still intimidating for those not already comfortable in the environment,” says Greg Nathan.

“Think about the opportunity the industry has in front of it – if we could make golf a more welcoming place for beginners… and convert more trials into committed golfers.”

Greg Nathan, President & CEO, National Golf Foundation

Greg Nathan, President & CEO, National Golf Foundation

1NGF , The Graffis Report 2024 (Golf Industry 2023 – Year in Review)

So, what now for golf course businesses? What are the immediate challenges being faced – and how do clubs and courses adapt?

The Challenge Ahead

Hitting Headwinds

ARGUABLY the single biggest issue facing golf course businesses comes from climate change and access to water for irrigation.

Water is at the core of sustainable development and economic growth – and a vital input for golf courses to produce the conditioning and playing experiences customers expect.

But as Syngenta’s groundbreaking Golf & Social Media industry reports series highlighted, golf has serious external reputational issues – and online complaints about courses ‘wasting water’ spike during droughts. Even more so when communities find their supplies restricted.

As Jim Croxton, Chief Executive of BIGGA, the international association for greenkeepers told the Growing Golf podcast, around 60% of UK golf courses are partly or wholly reliant on mains drinking water for irrigation. For some courses, this situation could be a ticking time bomb.

WATCH:

What about the United States?

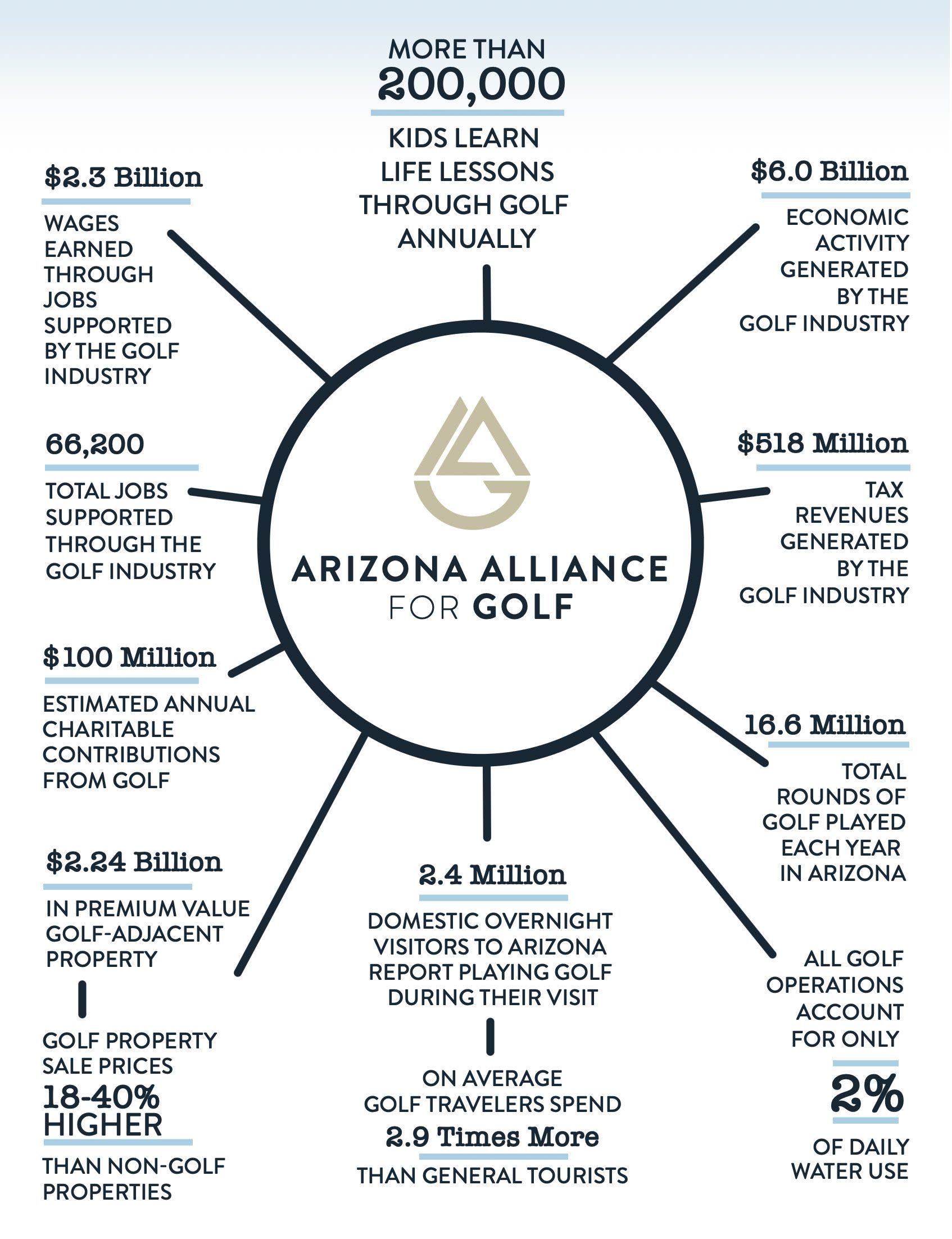

The solution in Arizona, where golf courses were falsely accused by a local newspaper of using more than their permitted share of water, was collaboration and communication.

Forming the Arizona Alliance for Golf, the group successfully won over state legislators and communities by demonstrating that golf uses just 2% of the state’s water, while returning a $6 billion economic benefit. No other water-consuming industry in the state comes close to that level of return.

“Most people in Arizona thought golf courses were using 30% to 60% of the state’s water. They were surprised to learn it was just 2%.”

WATCH:

Golf courses are having to get smart, rapidly, to demonstrate efficient and valid use of water.

Innovative technology and data are driving this transition. Syngenta’s collaboration with Spiio illustrates how digital tools are aiding course managers in optimizing resources. In-ground sensors provide continuous measurements of soil temperature, salinity, and moisture directly to their cell phones, enabling data-driven, real-time decisions and long-term trend tracking.

While new technologies and ongoing infrastructure investments offer solutions, clubs and courses are also confronting the immediate challenge of rising costs.

In the UK, Europe’s largest golf market, club consultancy Custodian Golf published a whitepaper in July 2024 stating clubs were experiencing rising maintenance, insurance and operational costs.

It estimated 433 clubs – approximately one-in-six – were in such poor financial health that urgent action was required to avoid closure. Co-author Phil Grice, a former chairman of the Golf Club Managers’ Association, wrote, “While many say golf is in a sunny place and backslap each other for a job well done, let’s be real and address what the data really tells us.”

In the US, there have been course closures, but they have typically been among those businesses at the value end of the market. This includes locations where development pressure has pushed up land values, potentially making it viable for a club owner to exit the business.

But market insights also suggest a level of price sensitivity at private clubs.

According to GGA Partners’ Club Members Perspective Report 2024, deteriorating club facilities (46%) and increased dues (44%) are the top two factors that could cause members to leave their club soon.

The report highlighted that while the membership experience was meeting a satisfactory level of quality for most (76%), not all members are willing to spend more to maintain them: 36% said they would pay more to elevate services, but only 23% indicated they would pay more to maintain their experience.

However, a key insight from the research was that members finding an emotional connection with their club was of greater value than the typical cost-benefit value. In short, heart over head.

“Price may always be top of mind, but clubs focusing on the emotional and quality value delivered to their members will see a different type of conversation around price and value.”

This important insight is aligned to wider shifts in consumer behavior and an emphasis on customers seeking ‘experiences’ as well as the emergence of a new ‘wellbeing economy’ - changes that offer both challenges and opportunities for golf.

A Different Approach

PROFESSIONAL services firm EY regularly surveys 21,000 consumers in 27 countries to analyze changes in consumer spending and identify trends as part of its Future Consumer Index. It says two years of lockdowns have had lasting effects on consumer priorities and people are now buying less, buying better and in different ways.

Among key drivers reshaping consumption patterns is the prioritization of experiences – activities that enrich consumer lifestyles. Arguably, golf has been a major beneficiary of this trend as people have sought access to golf’s green spaces and the physical, social and emotional wellbeing benefits the sport offers.

Simultaneously, there are growing calls to evaluate businesses in a different way, moving beyond the perceived narrow financial metrics of revenue and profit, which fail to account for the wider costs of consumption.

Instead, the ‘wellbeing economy’ is emerging, using the health of people and the planet as measurements of business success. Ultimately, it is a holistic account of business. For golf, it is an opportunity to underline the true, enhanced value of courses in relation to sustainability: the balance between people, planet and profit.

Ultimately, golf courses offer health and wellbeing benefits to people, can enhance biodiversity and store carbon and add value to local economies through income, jobs and taxes.

But one fundamental problem is that there is a frequent mismatch between what courses continues to sell and the reasons so many new customers are turning up to try golf.

Many clubs in particular continue to focus on traditional messaging around history, course challenge, competitions and etiquette… with a customer experience to match.

Disappointed, it’s the reason why many beginners walk away. The experience is not what attracted them to the sport.

Instead, clubs and courses have an opportunity to address customer motivations, communicate experiences and the wider benefits and value golf contributes to the wellbeing economy.

What Syngenta Thinks

Golf’s post-pandemic surge highlights the game’s enduring appeal, offering not only a sport, but a refuge where people can connect socially, enjoy the outdoors and enhance their wellbeing.

It’s heartening to see golf attract a broader audience – and the data suggests we are continuing on a positive trajectory. As a company that invests significantly in the golf industry, we're proud to have played our part in this. In addition to more female players and customers, we've welcomed more women into our business and into greenkeeping as a career.

However, while the current outlook is undeniably promising, it would be remiss not to recognise the challenges that lie ahead. And this is the case for all businesses; there is a constant need to reflect and reinvent to meet new customer, market and environmental needs.

From a personal standpoint, I believe golf's role as a sanctuary for mental and physical health has never been more important. Similarly, courses are a vital refuge for flora and fauna in an increasingly urbanizing world.

Yet, the increasing pressure on resources, particularly water, raises critical questions about the sport’s long-term sustainability. We must ensure that golf remains a responsible steward of the environment, especially in the face of growing scrutiny over its environmental impact. The objective use of data and an understanding of how modern courses operate is therefore vital.

Professionally, the onus is on clubs and course operators to evolve with the times. How do we respect the traditional whilst embracing change and innovation? Rising operational costs, coupled with changing consumer expectations, demand a more thoughtful approach.

Clubs must look beyond the traditional focus on history and competition, embracing the emotional connections that modern players seek. Technology offers promising solutions, from water management innovations to enhanced customer experiences, but investment and foresight are key.

Ultimately, we, and the golf industry, have an opportunity to lead by example, balancing financial health with environmental responsibility and community wellbeing.

If we can continue to foster inclusivity and ensure the sport is welcoming to all, while addressing the sustainability issues head-on, golf’s future will be as bright as its present.

It’s a time for careful reflection, thoughtful action, and optimism for what lies ahead.

Our team sees this as our daily work and I know that many others in the industry feel the same. Therefore we also need to work better together and tell these stories to the wider communities we work in to ensure that the modern reality of golf is well understood and that we are all working for a better future.

© Copyright 2024 Syngenta